Governance Risk Framework (Part 2)

Risk and Scientific Governance

The first part of this three-part series covered the stablecoin universe, defined decentralized risk management, and outlined the governance structure around the risk function.

In part two of the series, we'll take a more in-depth look at the risks underlying the system, describe how parameters in the MakerDAO system encapsulate those risks, and finally, outline the models that are most appropriate for measuring and managing those risks.

Part 3 will map out the decisions that Maker holders will need to make, the support they'll get to make those decisions, and the voting process for managing the risk function.

Risk Factors in Minting Dai

Participants in Maker governance need to understand how to identify, measure, and manage the above-mentioned risks so that Maker token holders understand the exposures they face and the information available to make decisions.

Risk factor to consider include:

Concentrated Exposure

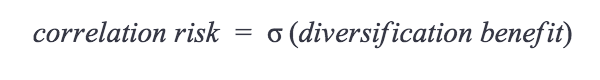

Correlation Risk

Credit Risk

Exogenous Risk

Liquidity and Volatility

Tokenomics and Qualitative Risk

Managing Risk

The responsibility of Risk Teams is to facilitate and contribute to the compilation of information to assess the qualitative features of the organization behind the token used as collateral. The process to compile data through due diligence has three parts and is conducted sequentially to use resources as efficiently as possible.

The three parts are:

- Collateral Onboarding covers the trade support structure, distribution of token holdings and available data series.

- Operational Assessment covers the functionality behind the token, from the organization itself, through to the governance mechanisms and rights of the token owner.

- Technological Assessment covers the robustness and security of the underlying technology.

The information compiled from the due diligence will be used to rate the features of the potential collateral token. The features of the organization to assign a rating to are:

- Team — Core team and advisors

- Community — Sentiment analysis

- Technology — Security and completeness review

- Market and Competitiveness — SWOT analysis

- Business Models — Structural and legal analysis

Assigning a rating to each feature will result in an overall rating. A score below a prerequisite value will place the token to the back of the queue, and a passing score is an adjustment factor to the risk parameters of the system.

Maker (MKR) Token Holders

Maker (MKR) Token Holders will create a qualitative risk template and assign ratings on this template. The model and information will be made available for MTH and other teams to use for themselves. Ultimately the risk function, made up of many groups, will collectively produce a weighted group rating for the token.

Token holders must use the available information, along with the collective rating, to decide whether to include the token into the collateral portfolio.

A rejected token will go to the back of the queue; otherwise, collateral will be included in the portfolio or assigned to be ‘reviewed.’

On ‘review’ means no decision made because of an impasse, or not enough information was available to make the decision.